Singapore Property market Update

As of December 7, 2024, Singapore's property market has shown signs of stabilization after a period of

rapi growth.

Private Residential Properties:

-

Price Trends: In Q3 2024, private residential property prices decreased by 0.7%, reversing the 0.9% increase from the previous quarter.

-

Landed property prices fell by 3.4%, while Non-landed property prices saw a slight uptick of 0.1%.

Regionally, the Core Central Region (CCR) experienced a 1.1% decline in non-landed property prices, whereas the Rest of Central Region (RCR) and Outside Central Region (OCR) recorded increases of 0.8% and 0.0% , respectively.

-

Rental Market: Private residential property rents rose by 0.8% in Q3 2024, rebounding from a 0.8% decline in the previous quarter.

This growth was driven by a 3.2% increase in landed property rentals and a 0.5% rise in non-landed property rentals.

Public Housing (HDB) Resale Market:

-

Million-Dollar Flats: The demand for high-value HDB flats surged, with a record 328 units sold above S$1 million in Q3 2024 , compared to 128 units in the same period the previous year.

Year-to-date, 747 million-dollar flats have been SOLD , surpassing the 469 transactions recorded in the entirety of 2023 .

-

Resale Prices: The HDB resale price index increased by 2.5% from Q2 to Q3 2024, with average unit prices rising by 3% during the same period.

Market Outlook:

The property market's moderation reflects a cautious stance among homebuyers toward high price levels

ami slower wage growth and soft economic conditions.

Despite these challenges, underlying demand remains resilient , supported by

healthy household liquidity.

Overall, 2024 has been a year of stabilization for Singapore's property market, with both private and public

housin sector adjusting to evolving economic conditions and policy measures.

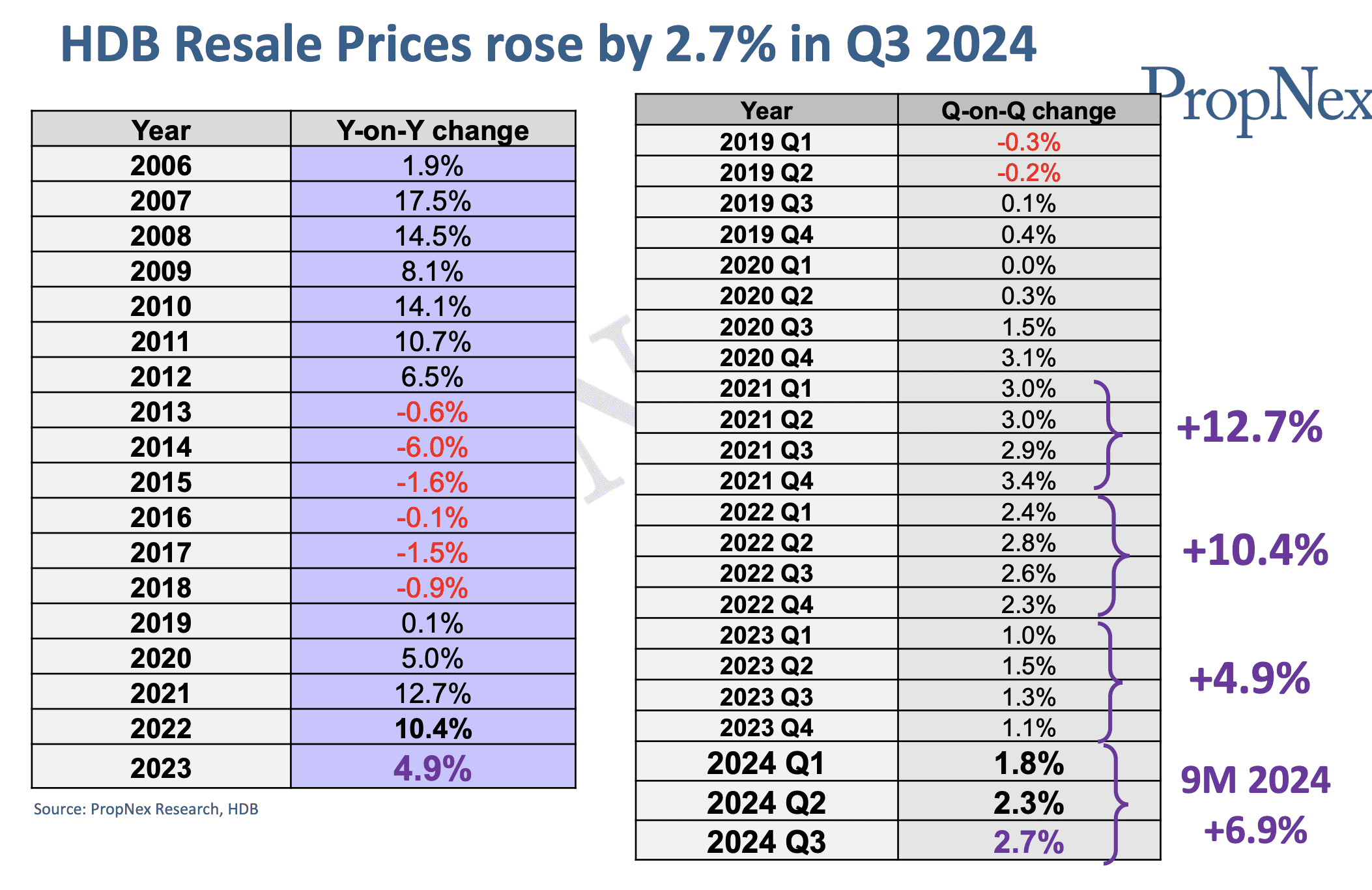

Singapore Property Index Since 2006

With the strong demand in the HDB resale market, you might be wondering whether to capitalize on the current trend or continue waiting. This is a key question many of you may have, especially with concerns like,

“What if the market goes down?”

While I can't cover everything here, I’d be happy to connect with you via Zoom or in person to better understand your needs and objectives.

From there, I can provide my honest opinion, address your concerns, and discuss how I can assist you in making an informed decision tailored to your situation.

How will this Index affect your decision?

With the property index doubling since 2006, what lies ahead in 2025 depends on key factors:

- Interest Rates: Potential rate cuts could enhance affordability and drive demand.

- Population Growth: A growing population and rising expatriate numbers sustain housing demand.

- Economic Stability: Steady GDP growth (2%-3%) supports property investments.

Opportunities:

- For Buyers: Lower rates and moderate price growth make 2025 a promising entry point.

- For Sellers: High valuations and potential buyer activity due to interest rate cuts could be advantageous.

2025 offers opportunities for both buyers and sellers, shaped by interest rates, population trends, and economic resilience.

In October 2024, Singapore's property market experienced a significant surge, with developers selling

738 new private homes (excluding executive condominiums), marking an 84% increase from September

and a 262% rise compared to October 2023. This uptick was largely driven by successful project launches

such as Norwood Grand and Meyer Blue.

In November 2024, Chuan Park achieved strong sales, with 696 out of 916 units sold (76%) at an average

price of S$2,579 psf . Emerald of Katong performed exceptionally well, selling 835 out of 846 units

(98.7%)at an average price of S$2,621 psf . Nava Grove sold 359 out of 552 units (65%) at an average price of

S$2,448 psf , while Novo Place(EC) recorde 286 out of 504 units sold (57%) at an average price of

S$1,654 psf .

Collectively, these projects sold 2,176 out of 2,818 units, achieving an impressive overall sales rate of 77%.

In summary, while the property market has experienced various cycles, current favorable conditions

suggest tha the demand observed in late 2024 is likely to continue into 2025, contributing to a resilient

property market.

Here are some important questions for consumers, incorporating the concept of

LEADING and LAGGING indicators:

- "How do interest rates, GDP growth, and population changes act as leading or lagging indicators for property price movements, and how can I use this understanding to make better decisions?"

- "What are the key leading indicators I should watch to anticipate changes in property prices, and how do lagging indicators like historical price trends provide context for my decisions?"

- "How can understanding leading indicators (such as population growth or economic expansion) help me predict future opportunities in the property market?"

- "In what ways can lagging indicators, like past property price trends, guide me in assessing whether the market is currently at its peak or due for a correction?"

- "Why is it important to differentiate between leading and lagging indicators when planning to buy or sell a property?"

- "How can I align my property decisions with these economic indicators to maximize my investments or capitalize on favorable market conditions?"

THE ORIE(TOA PAYOH)

Preview starting from 03th JANUARY 2025

The Orie is a forthcoming 99-year leasehold condominium situated at Lorong 1 Toa Payoh in Singapore's District 12. Developed collaboratively by City Developments Limited (CDL), Frasers Property, and Sekisui House, this project marks the first new residential launch in Toa Payoh in nearly a decade. The development comprises approximately 777 residential units across two 40-storey towers, offering a 1Br + Study to 5 Br with private lift to cater to diverse preferences and lifestyles.

The Orie is strategically located near Braddell MRT Station, providing seamless connectivity to key areas in Singapore.

Parktown Residence(Tampines North)

Targeted Preview 1st QTR 2025

Parktown Residence is an upcoming 99-year leasehold mixed-use development located along Tampines Avenue 11 in Singapore's District 18. Jointly developed by UOL Group, CapitaLand, and Singapore Land (SingLand), the project is set to feature approximately 1,193 residential units, complemented by retail and community amenities to cater to the lifestyle needs of residents.

The development comprises approximately 1Br + Study to 5 Br across 12 blocks , offering a cater to diverse preferences and lifestyles.

Elta(Clementi Avenue 1)

Targeted Preview 1st QTR 2025

Elta is an upcoming 99-year leasehold condominium located along Clementi Avenue 1 in Singapore's District 5. Developed jointly by MCL Land and CSC Land Group, the project is set to feature approximately 501 residential units across two 39-story towers. The development offers a variety of unit types, including 1- to 5-bedroom layouts, catering to diverse preferences and family sizes. Residents will benefit from modern amenities such as a 50-meter lap pool, fully-equipped gym, and lush landscaping.

The development is also in close proximity to reputable educational institutions, including Nan Hua High School and the N ational University of Singapore, making it an attractive option for families.

Aurelle of Tampines(Tampines North)

( Executive Condominium )

Targeted Preview 1st QTR 2025

Aurelle of Tampines is an upcoming Executive Condominium (EC) located at Tampines Street 62. Developed by Sim Lian Group, the project is set to feature approximately 760 residential units, offering a range of 3- to 5-bedroom layouts designed to cater to diverse family needs.

The development is situated near the forthcoming Tampines North Hub, a mixed-use development that will include retail outlets, dining options, and community spaces, enhancing the convenience and lifestyle options for residents.

It's strategically located near the future Tampines North MRT Station on the Cross Island Line , providing residents with seamless access to various parts of Singapore. Additionally, the Tampines Bus Interchange is within close proximity, further enhancing the connectivity for residents

The Housing and Development Board (HDB) has announced plans for the February 2025 Build-To-Order (BTO) sales exercise, offering approximately 5,000 flats across four estates: Kallang/Whampoa, Queenstown, Woodlands, and Yishun. This launch aims to provide a diverse range of housing options to meet varying needs and preferences.

Kallang/Whampoa:

- Location: Tanjong Rhu Road, near Geylang River.

- Units: Approximately 800 units comprising 2-Room Flexi, 3-Room, and 4-Room flats.

- Amenities: Proximity to Dunman High School and two MRT stations—Tanjong Rhu and Katong Park on the Thomson-East Coast Line.

- Highlights: Central location with potential panoramic views of Geylang River and Singapore Sports Hub.

Queenstown:

- Location: Mei Chin Road.

- Units: Around 1,110 units, including 2-Room Flexi, 3-Room, and 4-Room flats.

- Amenities: Near Queenstown MRT station, with access to shopping centers like IKEA, Anchorpoint, and Queensway Shopping Centre.

- Highlights: Mature estate with established amenities and connectivity.

Woodlands:

- Location: Near the sea, specific site details to be confirmed.

- Units: Approximately 1,500 units.

- Amenities: Expected to offer scenic views and access to waterfront recreational facilities.

- Highlights: Potential sea views and tranquil living environment.

Yishun:

- Location: Chencharu area, an emerging HDB residential zone.

- Units: Details on the number and types of units to be confirmed.

- Amenities: Proximity to upcoming developments and transport nodes.

- Highlights: Part of a developing residential enclave with modern amenities.

Sources:HDB.gov.sg

Thank you for taking the time to explore the insights I’ve shared about the property market.

We’ve touched on key trends, upcoming developments, and the factors influencing property prices, from economic indicators to market dynamics. Whether you’re considering buying, selling, or simply staying informed, understanding the market's nuances is crucial for making confident decisions.

If you have further questions or would like to discuss how these trends apply to your property goals,

feel free to reach out.

I’m here to help guide you through the complexities of the property landscape.

Once again, thank you for reading, and I hope this has provided valuable perspective for your journey in the property market.

I hereby wish you and your family a

Merry Christmas filled with

joy

,

love

, and

warmth

, and a

fantastic New Year ahead,

brimming with opportunities, success, and

happiness.

May 2025 bring you closer to your dreams and surround you with positivity. 🎄